AI-Powered ETF Portfolio Generator

Beat the market with deep learning algorithms that consistently outperform the S&P 500.

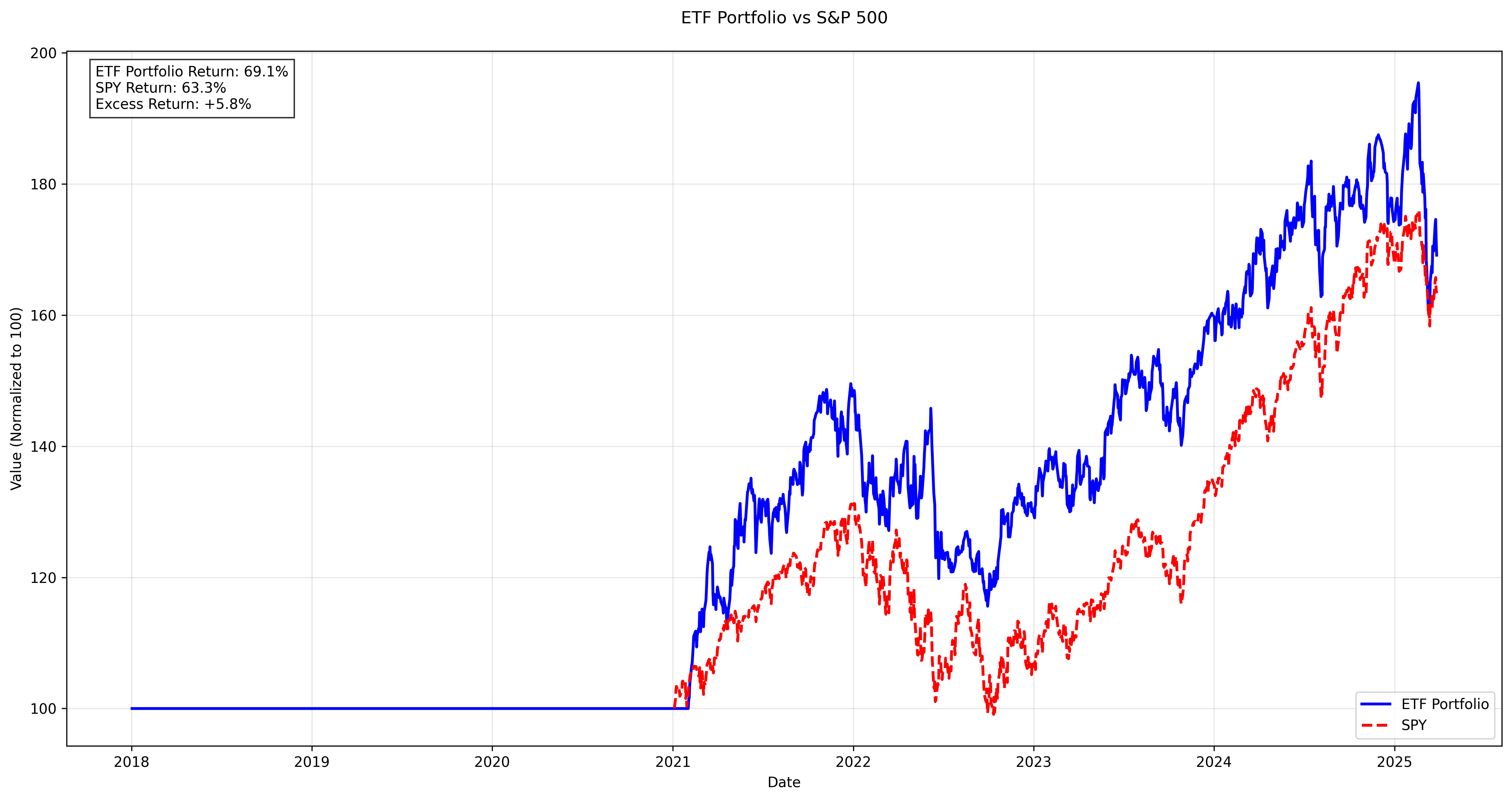

ETF Portfolio vs S&P 500

+69.1% ETF Return vs +63.3% S&P 500

Bull Market (2021)

+43.8%

+13.0% vs S&P500

Market Correction (2022)

+5.5%

+24.2% vs S&P500

Overall Performance

+69.1%

+5.8% vs S&P500

Generate Your ETF Portfolio

Select Market Scenario

Strong tech-led growth period with significant gains across major indices

Select Date Range

Generate Your First Portfolio

Select a scenario above and click "Generate Portfolio" to view ETF composition

How It Works

Deep Learning Model

Our LSTM and GCN neural networks analyze market patterns and optimize stock selection.

Dynamic Adaptation

System automatically adjusts to market regimes for bull markets and protecting against downturns.

Risk Management

Integrated risk controls including stop-loss, drawdown limits, and sector concentration rules.

Advanced ETF Generation Features

Portfolio Optimization

Our advanced optimizer determines optimal weights for selected stocks, targeting specific volatility levels or maximizing risk-adjusted returns based on market conditions.

Options Strategy

Optional overlay strategies like covered calls to generate additional income and reduce portfolio volatility, powered by our proprietary options pricing model.

Technical Indicators

Advanced analysis with Moving Averages, RSI, MACD, Bollinger Bands and more to identify optimal entry and exit points for portfolio rebalancing.

Technical Implementation

Data Processing Pipeline

- Time-series standardization and feature engineering

- Price and volume trend analysis across multiple timeframes

- Automated outlier detection and data cleaning

- Feature correlation analysis and dimension reduction

Model Architecture

- Combined LSTM and GCN layers for temporal and cross-asset correlation

- TensorFlow/Keras implementation with GPU acceleration

- Bayesian optimization for hyperparameter tuning

- Ensemble methods for improved prediction stability